Real estate investment can be a stable source of income, but long-term success depends on how well you prepare for unexpected problems. These may include natural disasters, equipment failure, vacancies, or changes in interest rates. In this article, we look at how experienced investors use insurance and reserve funds to handle unforeseen events without disrupting their strategy.

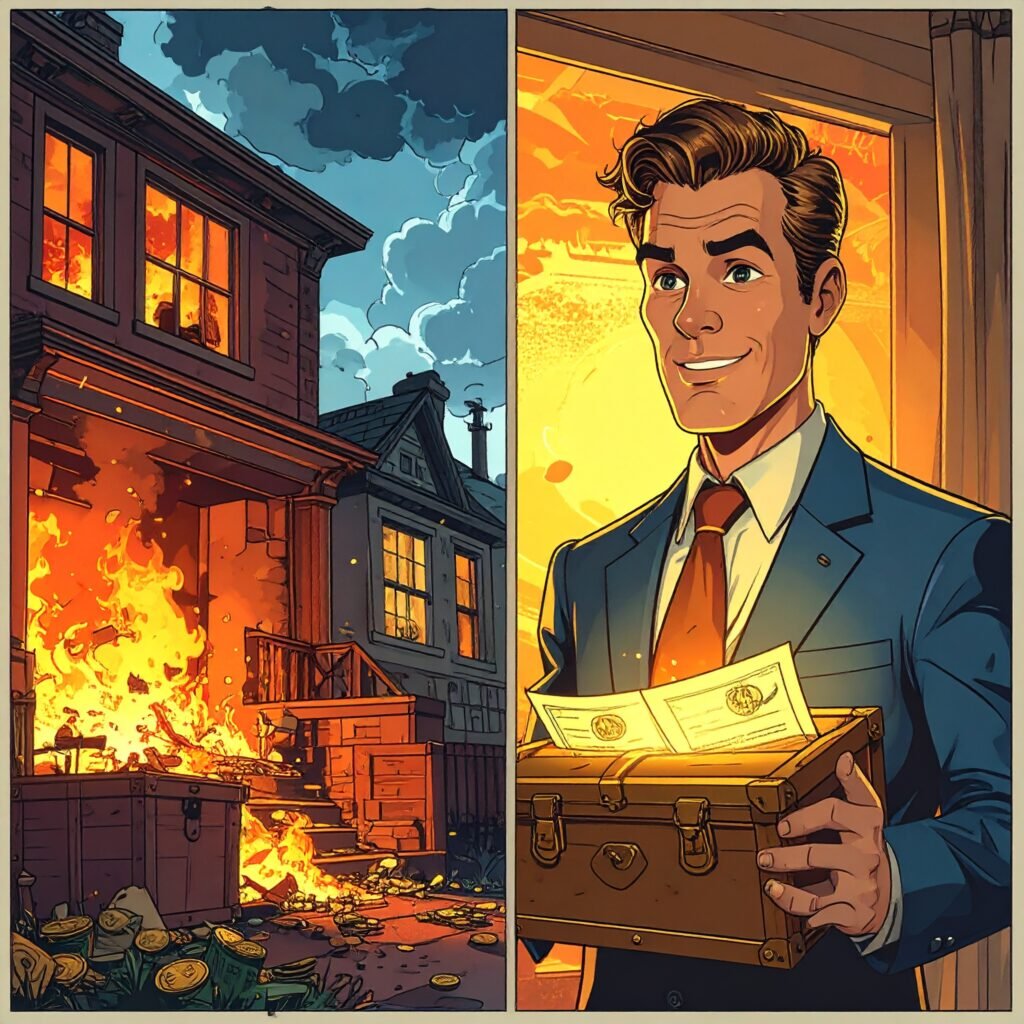

Insurance is the First Layer of Protection

Most investors begin by securing two key policies:

- Fire insurance covers not only fires but also lightning, wind damage, water leaks, and theft. It is often required by lenders.

- Earthquake insurance is optional but essential in high-risk areas. Fire insurance alone does not cover earthquake-related damage.

Savvy investors do not just sign up for insurance. They regularly review their policies to ensure the coverage amount and scope are appropriate. Choosing based on low premiums alone may result in insufficient coverage, forcing owners to pay out of pocket. Some investors also add facility liability insurance to protect against damage to others.

Rent Guarantee Services Provide Backup

A rent guarantee service helps when tenants stop paying. The guarantee company covers a certain number of months, giving the landlord peace of mind. This service is popular among long-term investors who want to reduce financial and emotional stress from rental arrears.

Cash Reserves Are Essential for Quick Response

Insurance does not cover everything. That is why successful investors build up cash reserves to deal with:

- Equipment breakdowns

- Extended vacancies

- Emergency repairs

- Tax obligations

Many set aside a fixed portion of rental income each month in a separate account. This money is saved for repairs, upgrades, and annual taxes.

Common targets for reserve funds include:

- Six months of rental income

- The combined amount of estimated annual repairs and property tax

Major repairs such as roof waterproofing or exterior walls can cost several hundred thousand yen. Having the funds ready avoids cash flow disruption.

Interest Rate Hikes Require Preparation

Investors with variable-rate loans often prepare for future increases by running repayment simulations. They estimate their monthly payment if rates rise by one percent and set aside funds to match that scenario.

True Resilience Means Being Ready

Resilient investors are not those who avoid risk. They are the ones who plan for it in practical terms. Having both insurance and cash reserves allows them to respond calmly and keep their investment stable.

Investing Also Means Protecting What You Own

A profitable asset can quickly turn into a liability if it is not protected. Setting up solid systems to guard against risk is what turns real estate into a true long-term asset.